It is vital to have good business credit scores that help with the success and health of your business. Also, it comes in handy in the future when you need to get any form of business financing. Not only do many companies help to build business credit, but there are multiple ways you can explore that will help to improve the credit score for your business. So, you can apply to build business credit fast for your business. Anyhow, if you find yourself with a less than a stellar business credit report, there are many fast ways to improve your credit score. In this article, are ways that will help you improve your business credit score.

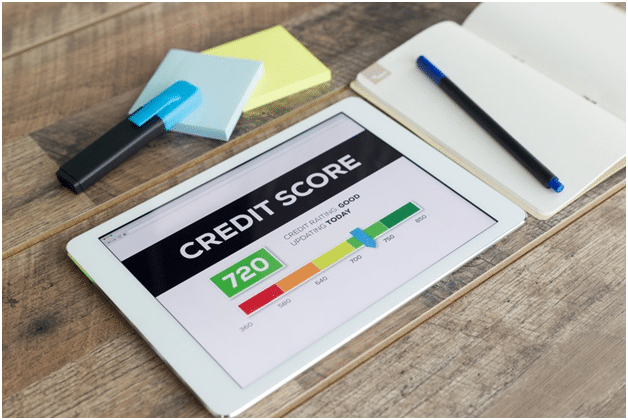

- Go through your credit report

Firstly, it is important to check your credit report from the reporting companies. These reports are not free, but they are a necessary step to understand your business credit score. Once you are familiar with your credit score, you know what you are working with, and it is easier to improve the score. Go through to find out any disputable items on the report and the accounts that are affecting your score negatively. Plus, if you have a high credit score, it means that you can borrow money while a lower one will prevent you from getting any business financing at all.

- Have positive payment experiences to your credit file

Since credit scores influence the finances your business can secure. It is important to have positive payment experiences. Therefore, take advantage to create a good credit score file with various suppliers and vendors as not all share the payment data with the business credit reporting agencies. So, through the credit reporting agency, you can add trade references that you have to your company’s credit file. The more positive payment experiences you have to add to your credit file, the better.

- Decrease the credit utilization ratio

To determine the credit scores, reporting agencies look at the ratio of credit used about the credit amount available. Thus, it is best if you can maintain that ratio under 15%. To ensure this happens, pay off your balances or get them as low as you can, as it is a sure way to decrease the ratio. Also, by asking your credit provider to increase your limit, you will be successful in decreasing the ratio. If you decrease the amount of money you spend on credit, it will also count. Optionally, you can opt to open a new line of credit, as much as it seems counterintuitive, it helps to decrease the ratio, and you have more credit that you are not using, making you look good to reporting agencies.

- Dispute any inquiries and errors

Is what reported on your company up to date and accurate? Unpaid accounts and inquiries will negatively affect your credit report. Yet, it is possible to work with credit reporting agencies and credit card companies to remove any poor feedback that is on your credit file. For this reason, something that should not be there, call it to dispute. In this way, you will improve your business credit score and faster than when it is full of inquiries and errors.

- Pay your bills on time

If you are keen on paying our bills on time, you will always have a good credit score. It is an easy way to improve your credit score for the business. However, if you do not pay your bills on time, your credit score will be affected negatively. Because of this, no matter how best you try to improve your score, it will be canceled as you will be considered a debt risk. Hence, try your best to pay your bills as it is a fast and easy way to improve your credit score.

- Establish credit accounts with your suppliers

If you find that you are working with specific suppliers repeatedly and you have a good credit relationship. It is best to establish a credit account with them to increase positive payments to your credit file. By doing this, you will improve your business credit score, which is vital in getting a loan for your business, among many other things.